All Categories

Featured

Table of Contents

The performance of those funds will determine how the account expands and exactly how huge a payout the buyer will at some point receive.

If an annuity customer is wed, they can select an annuity that will certainly continue to pay earnings to their spouse ought to they die. Annuities' payments can be either immediate or deferred. The fundamental inquiry you require to consider is whether you desire routine earnings currently or at some future date.

A credit enables the cash in the account even more time to expand. And a lot like a 401(k) or an specific retired life account (INDIVIDUAL RETIREMENT ACCOUNT), the annuity proceeds to collect earnings tax-free up until the cash is taken out. Over time, that can construct up right into a considerable sum and lead to bigger payments.

With an instant annuity, the payouts start as quickly as the buyer makes a lump-sum payment to the insurer. There are a few other important choices to make in getting an annuity, depending upon your conditions. These consist of the following: Customers can schedule repayments for 10 or 15 years, or for the rest of their life.

Highlighting the Key Features of Long-Term Investments Key Insights on Fixed Vs Variable Annuity Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Income Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Simplified Key Differences Between Fixed Income Annuity Vs Variable Growth Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing What Is Variable Annuity Vs Fixed Annuity Financial Planning Simplified: Understanding Tax Benefits Of Fixed Vs Variable Annuities A Beginner’s Guide to Fixed Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

That may make good sense, as an example, if you need an earnings boost while paying off the last years of your home loan. If you're wed, you can pick an annuity that pays for the remainder of your life or for the rest of your spouse's life, whichever is longer. The last is commonly described as a joint and survivor annuity.

The option between deferred and immediate annuity payments depends largely on one's financial savings and future profits goals. Immediate payouts can be valuable if you are already retired and you need an income to cover everyday costs. Immediate payouts can start as quickly as one month into the acquisition of an annuity.

Individuals typically acquire annuities to have a retirement income or to construct financial savings for an additional objective. You can acquire an annuity from an accredited life insurance policy representative, insurance provider, financial coordinator, or broker. You need to speak with an economic consultant concerning your requirements and objectives prior to you buy an annuity.

The difference in between the 2 is when annuity settlements start. You do not have to pay taxes on your earnings, or contributions if your annuity is an individual retired life account (INDIVIDUAL RETIREMENT ACCOUNT), up until you withdraw the profits.

Deferred and immediate annuities offer a number of alternatives you can choose from. The alternatives offer various degrees of potential threat and return: are assured to earn a minimal passion rate.

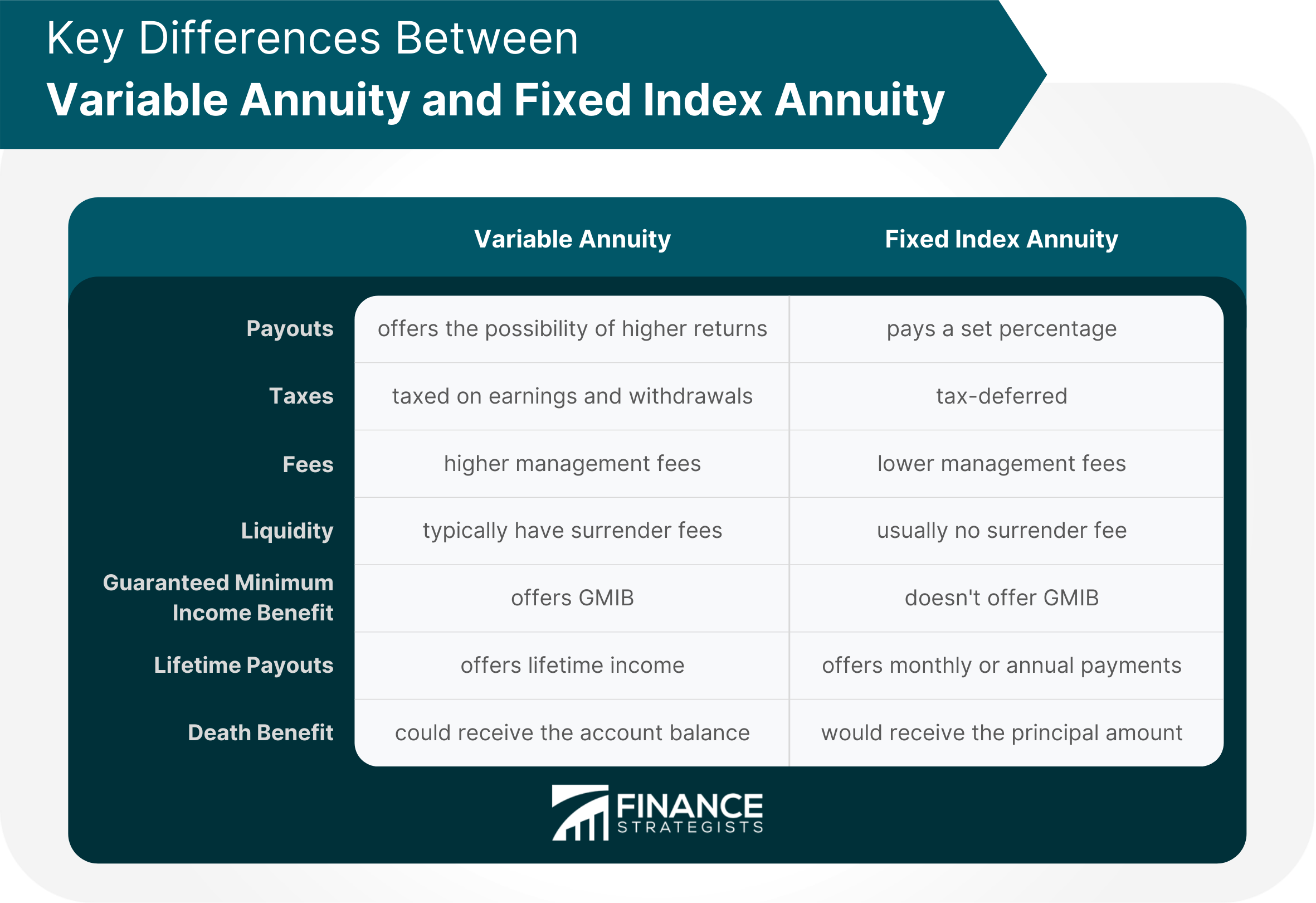

Variable annuities are greater threat since there's a possibility you might lose some or all of your money. Fixed annuities aren't as dangerous as variable annuities due to the fact that the investment risk is with the insurance company, not you.

Analyzing Strategic Retirement Planning A Closer Look at Immediate Fixed Annuity Vs Variable Annuity Breaking Down the Basics of Indexed Annuity Vs Fixed Annuity Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Is a Smart Choice Choosing Between Fixed Annuity And Variable Annuity: A Complete Overview Key Differences Between Fixed Annuity Vs Variable Annuity Understanding the Risks of Retirement Income Fixed Vs Variable Annuity Who Should Consider Fixed Vs Variable Annuity? Tips for Choosing Annuities Variable Vs Fixed FAQs About Fixed Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Annuity Or Variable Annuity A Closer Look at How to Build a Retirement Plan

Set annuities ensure a minimal rate of interest price, generally between 1% and 3%. The firm may pay a higher rate of interest price than the guaranteed rate of interest rate.

Index-linked annuities reveal gains or losses based upon returns in indexes. Index-linked annuities are a lot more intricate than dealt with deferred annuities. It is essential that you understand the attributes of the annuity you're considering and what they suggest. Both legal functions that impact the amount of interest credited to an index-linked annuity one of the most are the indexing approach and the engagement rate.

Understanding Fixed Index Annuity Vs Variable Annuities A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Benefits of Fixed Index Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: A Complete Overview Key Differences Between Pros And Cons Of Fixed Annuity And Variable Annuity Understanding the Key Features of Variable Vs Fixed Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Income Annuity Vs Variable Annuity FAQs About Fixed Index Annuity Vs Variable Annuities Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Tax Benefits Of Fixed Vs Variable Annuities A Closer Look at How to Build a Retirement Plan

Each relies upon the index term, which is when the business determines the passion and credit reports it to your annuity. The establishes how much of the increase in the index will certainly be used to calculate the index-linked interest. Other vital functions of indexed annuities include: Some annuities top the index-linked rate of interest rate.

The flooring is the minimum index-linked passion rate you will certainly earn. Not all annuities have a floor. All dealt with annuities have a minimal surefire worth. Some business use the average of an index's value instead than the value of the index on a defined day. The index averaging might occur any type of time during the regard to the annuity.

Highlighting Fixed Annuity Or Variable Annuity Key Insights on Annuity Fixed Vs Variable Defining the Right Financial Strategy Advantages and Disadvantages of Fixed Vs Variable Annuity Pros Cons Why Fixed Indexed Annuity Vs Market-variable Annuity Matters for Retirement Planning How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Annuity Vs Equity-linked Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Indexed Annuity Vs Market-variable Annuity Financial Planning Simplified: Understanding Fixed Vs Variable Annuities A Beginner’s Guide to What Is Variable Annuity Vs Fixed Annuity A Closer Look at Fixed Indexed Annuity Vs Market-variable Annuity

Other annuities pay substance rate of interest throughout a term. Substance rate of interest is rate of interest earned on the cash you saved and the interest you earn.

If you take out all your cash prior to the end of the term, some annuities will not credit the index-linked rate of interest. Some annuities may credit only component of the passion.

This is due to the fact that you bear the investment risk rather than the insurance policy business. Your representative or economic adviser can help you determine whether a variable annuity is ideal for you. The Securities and Exchange Payment classifies variable annuities as safeties due to the fact that the efficiency is obtained from stocks, bonds, and other financial investments.

An annuity contract has two phases: a buildup stage and a payment phase. You have numerous alternatives on exactly how you add to an annuity, depending on the annuity you get: enable you to select the time and quantity of the repayment.

permit you to make the same payment at the very same interval, either monthly, quarterly, or annually. The Internal Earnings Service (INTERNAL REVENUE SERVICE) regulates the taxes of annuities. The IRS enables you to postpone the tax on revenues till you withdraw them. If you withdraw your revenues before age 59, you will probably need to pay a 10% very early withdrawal penalty along with the tax obligations you owe on the interest earned.

After the buildup stage ends, an annuity enters its payment stage. This is in some cases called the annuitization stage. There are several alternatives for obtaining payments from your annuity: Your business pays you a dealt with amount for the time stated in the contract. The firm pays to you for as long as you live, however there are none repayments to your beneficiaries after you die.

Exploring Pros And Cons Of Fixed Annuity And Variable Annuity A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Variable Vs Fixed Annuity Can Impact Your Future Fixed Vs Variable Annuities: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Variable Annuity Vs Fixed Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Interest Annuity Vs Variable Investment Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Vs Fixed Annuity A Closer Look at Choosing Between Fixed Annuity And Variable Annuity

Numerous annuities charge a fine if you take out money prior to the payout stage. This fine, called an abandonment charge, is generally highest possible in the early years of the annuity. The fee is commonly a portion of the withdrawn money, and generally begins at about 10% and goes down annually up until the abandonment period mores than.

Annuities have actually other fees called loads or commissions. In some cases, these costs can be as much as 2% of an annuity's worth.

Variable annuities have the capacity for greater incomes, however there's more danger that you'll shed cash. Beware concerning placing all your assets into an annuity. Agents and companies must have a Texas insurance policy certificate to lawfully offer annuities in the state. The issue index is a sign of a firm's client service document.

Take time to determine. Annuities marketed in Texas must have a 20-day free-look period. Replacement annuities have a 30-day free-look period. Throughout the free-look period, you may terminate the contract and get a full reimbursement. A monetary adviser can assist you review the annuity and contrast it to other financial investments.

Table of Contents

Latest Posts

Decoding How Investment Plans Work Everything You Need to Know About Variable Vs Fixed Annuities Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Why What Is

Analyzing Strategic Retirement Planning A Comprehensive Guide to Investment Choices What Is Fixed Income Annuity Vs Variable Growth Annuity? Pros and Cons of Various Financial Options Why Choosing the

Understanding Fixed Indexed Annuity Vs Market-variable Annuity A Closer Look at How Retirement Planning Works Defining Annuity Fixed Vs Variable Benefits of Variable Annuity Vs Fixed Annuity Why Pros

More

Latest Posts